Invoices for event participants – Integration of the organizer’s account with the inFakt.pl and wFirma.pl platforms

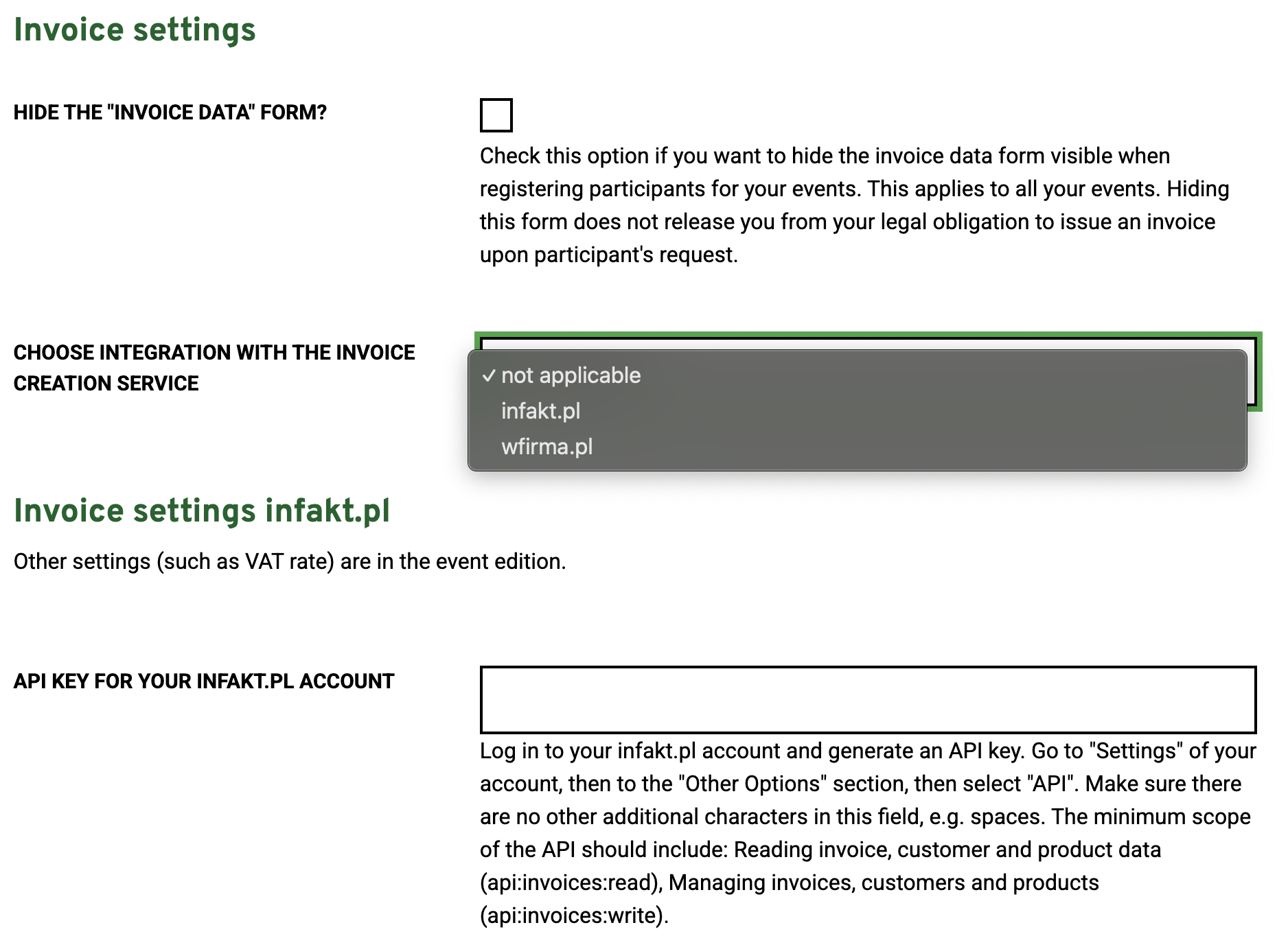

Invoicing settings are available in the organizer's account settings. Page opens in a new window. The page opens in a new window, and in the event editor for each event. These settings allow you to integrate your Event on Click organizer account with your inFakt.pl or wFirma.pl account. These two platforms allow you to automatically generate and send invoices to customers via the email address provided in the ticket purchase (event registration) form. The goal of this type of integration is to automatically generate and send an invoice to the user shortly after completing an online payment or after the organizer approves the registration (in the case of payment by standard bank transfer).

Invoice settings are located in 2 places:

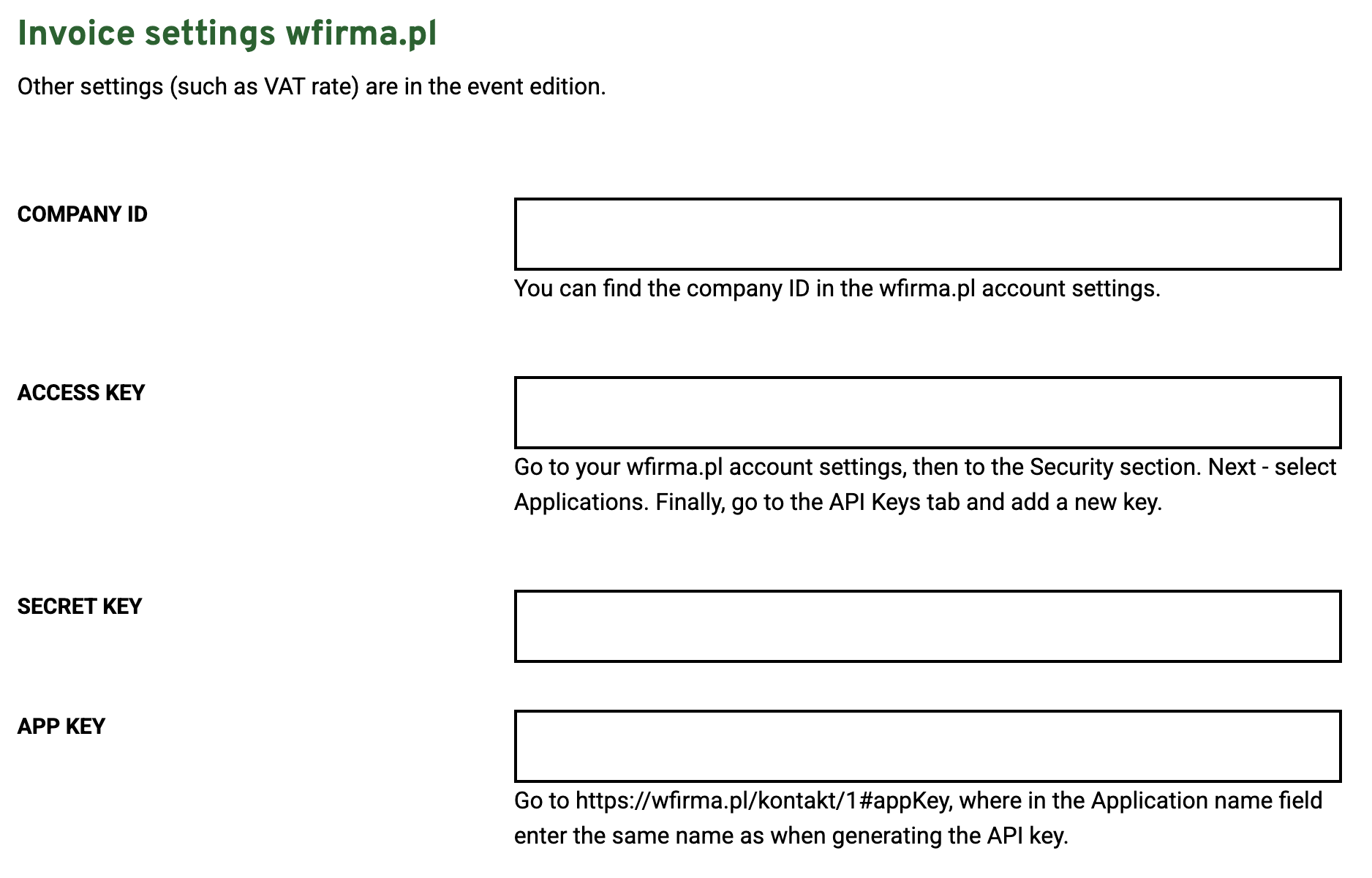

- Event on Click organizer account settings: where you will provide your API key enabling integration with a selected external service (inFakt.pl or wFirma.pl)

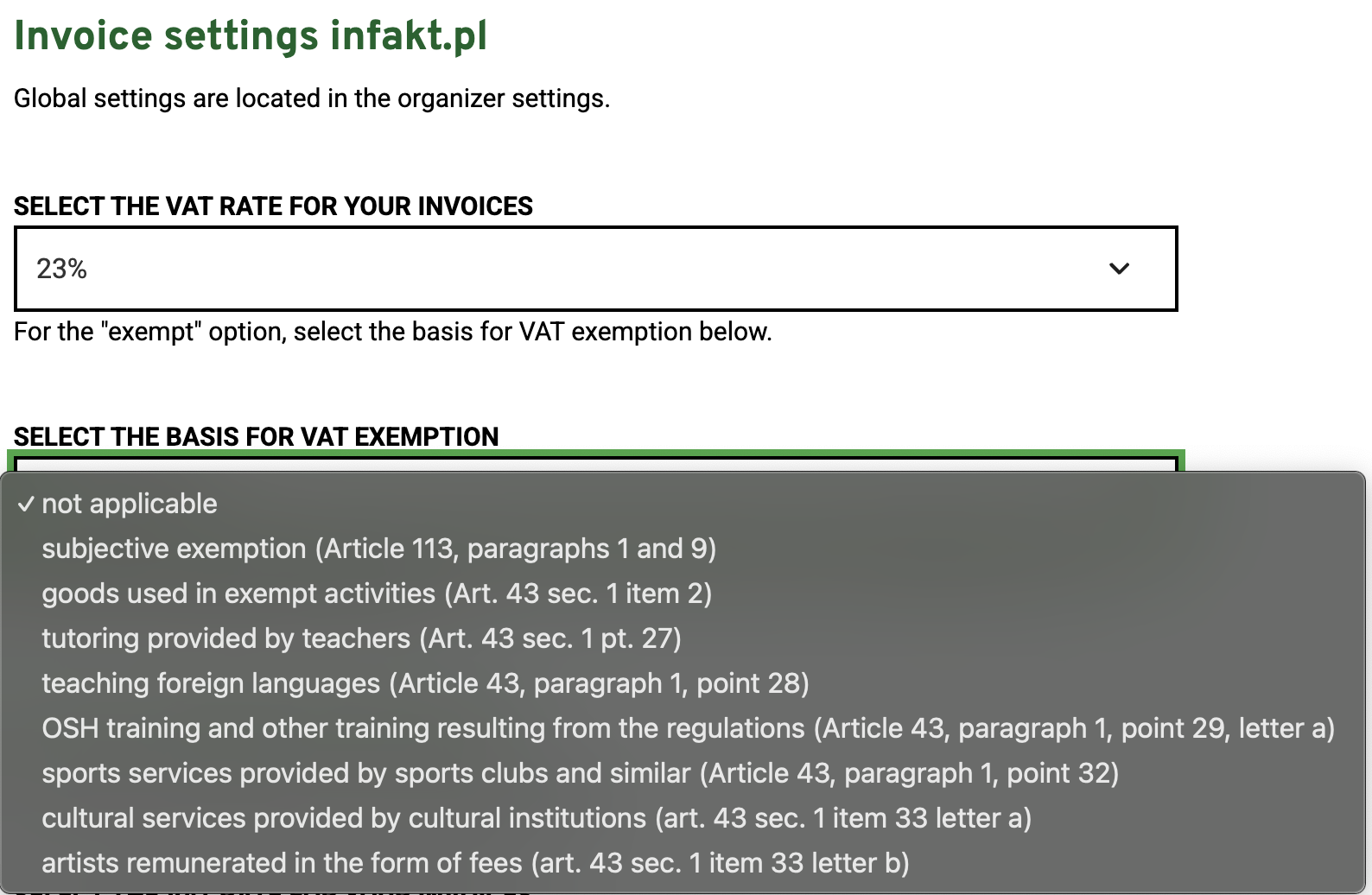

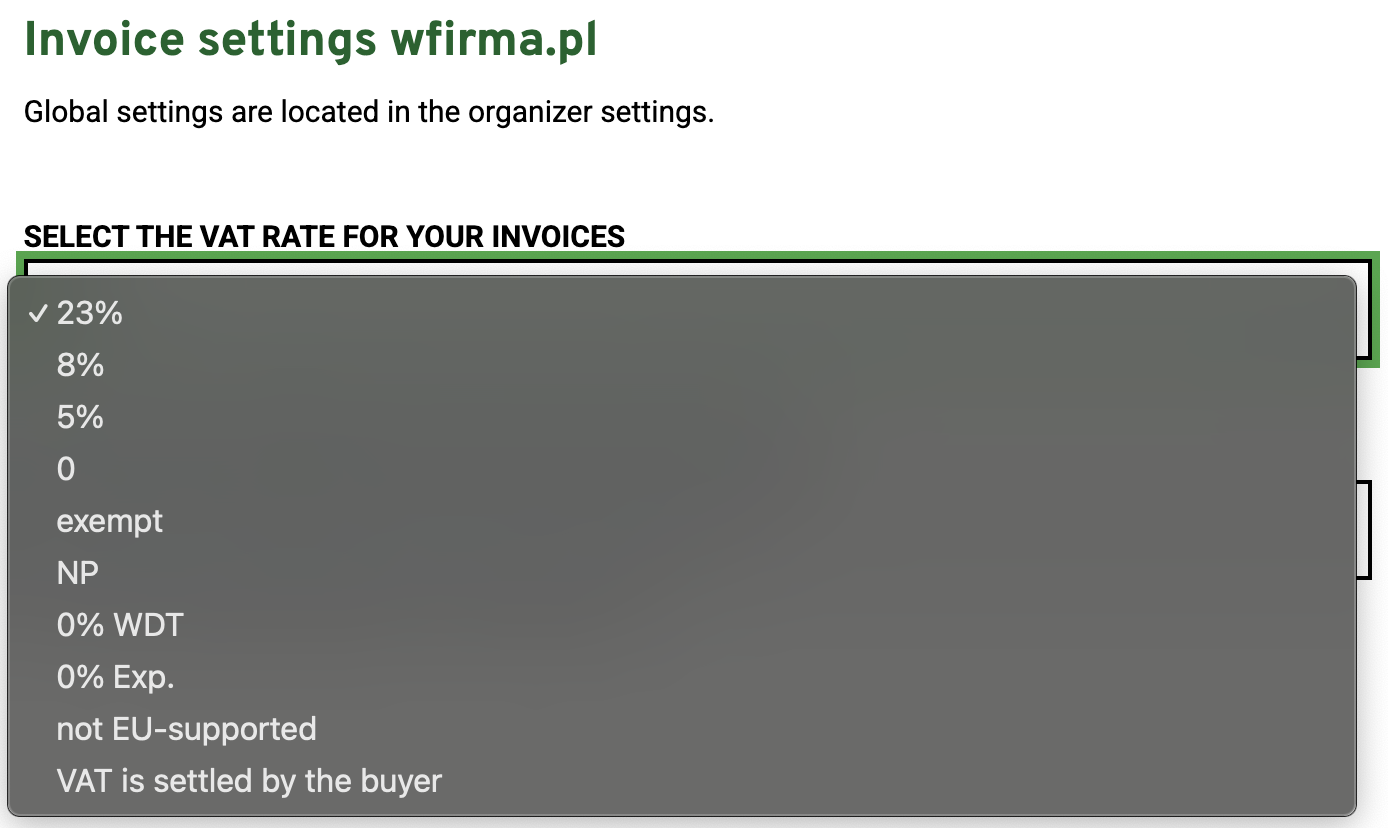

- Edit event, where you will define the VAT rate, and in the case of VAT exemption, you will add the appropriate information to the invoice

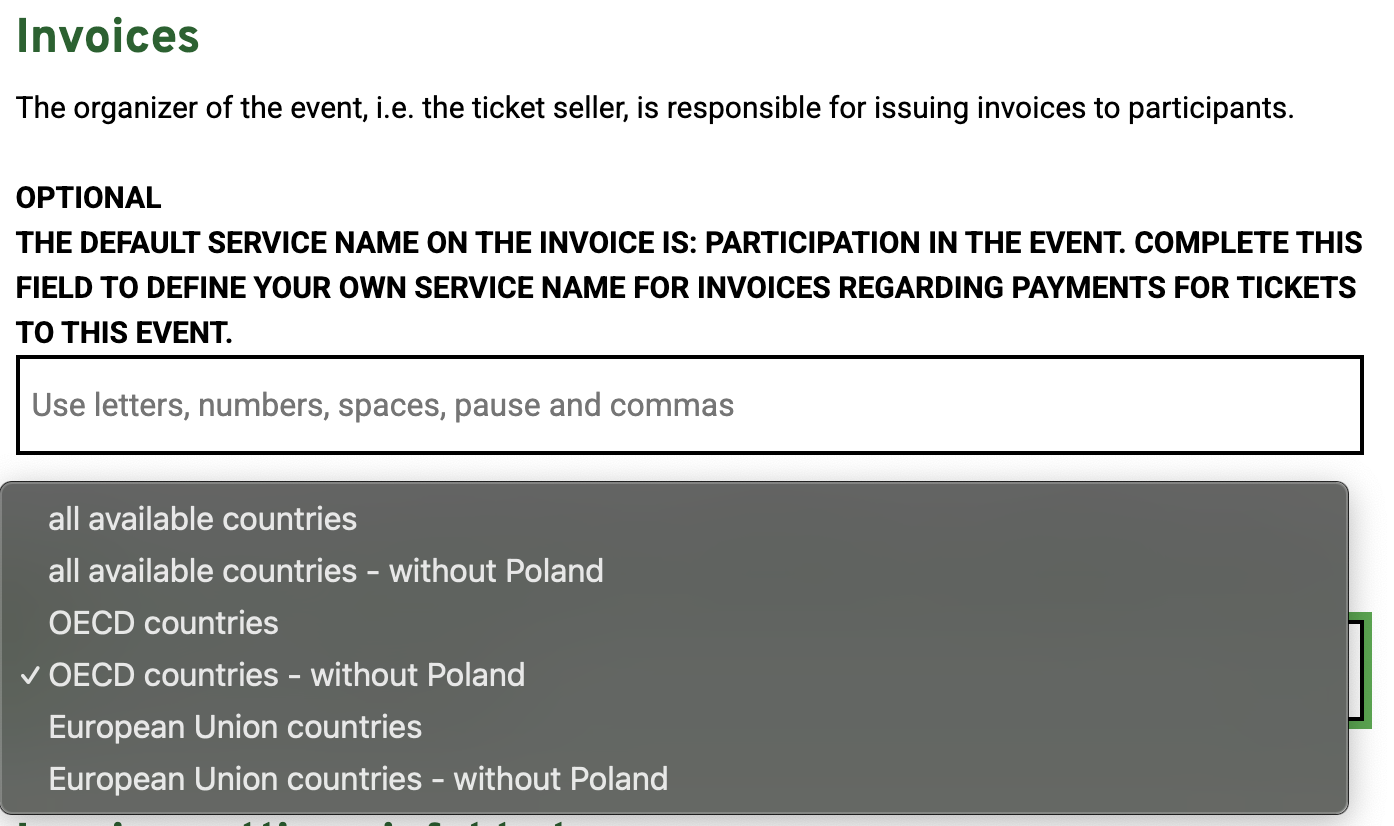

- For events with the USD or EUR sales currency, you can set a shorter list of countries to choose from in the „invoice data” form. The full list includes as many as 105 countries, however, you can only choose the list of European Union countries (27 countries, you can optionally exclude Poland from this list) or the list of OECD countries (36 countries, you can optionally exclude Poland from this list). List of all countries: https://eventon.click/en/online-payments/online-payment-methods-and-currencies/

Detailed information about invoices

- The invoice will be automatically generated based on the data provided by your client only if the ticket is paid online or the ticket is manually approved by you in the organizer’s panel (in the case of payment by traditional transfer).

- The invoice will be automatically sent to the client’s email address provided in the ticket purchase form (event registration). The sender of this message will be the inFakt.pl or wFirma.pl service. In your account on the invoice operator’s website, you will see the appropriate information or messages confirming that the invoice has been sent.

- The invoice message will be sent to the client within less than a minute from the moment of paying for the ticket online or manually approving the ticket by you (in the case of traditional transfer). In the case of the infakt.pl website: a copy of the invoice will also be sent to the email address assigned to your account on the inFakt.pl website.

- After sending the invoice to your client, in the Event on Click organizer panel you will see the appropriate information in the list of participants in the Participants tab and in the details of the given ticket.

- The invoice will be marked on the invoice operator’s website as a paid invoice.

- In the event edition, you will define the VAT rate („Payments” tab). Defined ticket prices are always gross amounts. The invoice operator system will automatically calculate the net amount and the VAT amount.

- There will be only 1 item on the invoice with the amount of the entire ticket (entire order) regardless of the number of individual tickets purchased as part of the same order. The default name of this service is „Participation in the event”, which you can change in the edition of a given event in the „Payments” tab.

- Each invoice has a note (a note at the bottom of the invoice) with information about the ticket number in the Event on Click system, e.g. Event on Click: ticket no. 12345678.

- When the currency of the ticket (order, transaction) is PLN, the invoice will be generated in Polish. If the currency is USD or EUR – in English.

- When the event has a defined currency of PLN, the default country for the „invoice data” form is Poland and such a country will be transferred to the invoice operator service along with the data provided by the customer. If the event has a set currency of USD or EUR, the customer can choose their country independently.

- In the case of USD or EUR currency, the invoice will contain a note with information on the average NBP exchange rate from the business day preceding the transaction date. This does not apply if you set the organizer’s account to be exempt from VAT. Example note: Exchange rates table No. 013/A/NBP/2025 of 2025-01-21. USD/PLN (exchange rate: 4.1101).

- Invoice numbering is according to the default settings in the invoice operator’s service.

Screenshots of new settings in the organizer’s account and in the event edition

New settings in the organizer’s account

New settings in event editing